FAQs by Home Sellers

Below are some of the most FAQs by Home Sellers that I have answered while working as a real estate agent in North Carolina.

How do I set the list price?

Your listing agent is an invaluable resource to help you determine the best possible price for a quick sale. Your agent will research the market to see what sold recently in your community and prepare a Comparable Market Analysis (known as a CMA). This report will include the following:

- List of properties sold for in the last six months

- How quickly homes have sold

- Current market conditions

- List of other active listings

- Condition of your home

After reviewing this report, sellers will be in a better position to know what value range their home falls into in the current local real estate market. Remember a listing gets most of the showing activity when it is new to the market and has the best chance of selling during this time.

Can I use an Internet Valuation Tool to set my List Price?

Many websites offer Instant Home Values, such as Zillow and Trulia. But a word of caution. These websites can be a good place to start and get a general idea of pricing. Instant home values are generated from computer models to come up with a home’s value from public records.

These estimates do not take the place of a visual inspection by a Realtor who will research all the local information regarding your home and community to arrive at a suggested value range. These values can be off by a significant amount. You do not want to trust a computer model with your most valuable asset. For more information check my post on Automatic Valuation Models.

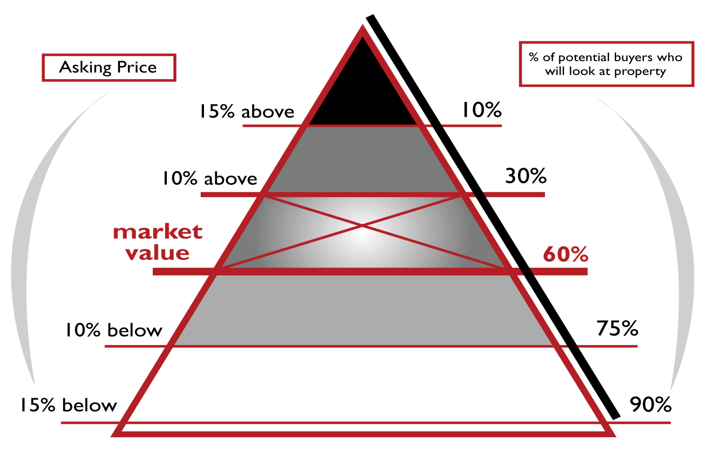

Should I price my home a little high to allow for negotiations?

It is always a mistake for sellers to price the home above its market value thinking that buyers will still look at the property and negotiate. Let’s take a look as to how this might work against the sellers. For example, say the best price to list a home would be in the $190,000 to $200,000 price range according to the comparable homes recently sold. But the sellers decide they want to list it at $205,000 to start with, so they have room to negotiate.

The home is not overpriced by much; but here is one problem with this thinking. Most buyers today find out about new listings on the market by setting up a buyer’s account on the internet. When the buyers set up an account to get new listings, they pick criteria by which the system will send them listings. There is a minimum and maximum price range they enter. So, let’s assume they set the maximum price at $200,000. They won’t see the new listing priced at $205,000 when it comes on the market, which might have been perfect for them.

Is Assessed Value the same as Market Value?

Assessed Value is not the same as Market Value. When shopping for a home, buyers may encounter a variety of home values on any given property. These different values on the same home can be confusing. Each home value serves a particular purpose.

Assessed Value is for taxation purposes by your local municipality. A home’s tax value is multiplied by the tax rate to determine what your yearly property taxes are. The assessed value does not impact on how much your home is worth to a potential buyer in the marketplace.

Market value is the fair price for a particular property based on current market conditions. This value is based on supply and demand, not the opinion of a city or county tax official. When a home is listed at Market Value, it will sell in a reasonable amount of time. Fair Market Value is arrived at by comparing what similar homes have sold for recently.

Go to my Post on Home Values to read more on the different types of home values.

What can I do to help my home sell faster?

First, set the correct list price in the beginning. Second, make sure the home is clean and ready for showings and agents have easy access. A property needs to show at its absolute best when it is new to the market to attract multiple showings and sell at the best possible price. Getting your home in shape to list will require some time and work on your part, but it doesn’t necessarily require a lot of money.

9 Insights for Preparing Home to Sell

- Highlight the rooms that are the most important to buyers like the living room, master bedroom, and kitchen.

- Our home reflects our personality and style. However, when you put the home on the market to sell, you need to depersonalize the space. You want potential buyers to be able to visualize their things in the space.

- Remove items that are not necessary. By decluttering, you will make your space appear larger. Space is what sells a home.

- Make your home sparkling clean which includes your baseboards, windows, cabinets, and walls. A clean home suggests to potential buyers that the sellers have taken good care of the property.

- It is a good time to tackle small needed repairs such as dents in the walls, scratches, and holes in sheetrock. If not repaired, this suggests neglect to buyers.

- Go neutral in your color scheme. Vivid colors in a home might reflect your personality, but it can be a major turn off for buyers.

- Check the exterior of your home and fix and clean where necessary. For example, your exterior siding might need to be pressure washed. Shrubs might need trimming.

- Make sure all lights in a room have ample wattage. For showings and listing pictures, open curtains and blinds to let in light.

- To help buyers visualize their things in a room, rearrange the room’s furniture for as much walkable space as possible.

What are my costs in selling my home?

Each party in a real estate transaction will have closings costs. Here is a list of some possible seller expenses:

- Mortgage balance and prepayment penalties, if applicable

- Other claims against your property, such as unpaid property taxes

- Unpaid special assessments

- Document stamps (transfer taxes) on the deed

- Real Estate Commission

- Attorney fees for deed preparation

- Closing costs for buyers if negotiated in the contract

- Contractor repair bills

What is “Agency” in the Real Estate Transaction?

The term “Agency” is used to determine what legal responsibilities your real estate professional owes to you. All states today have laws regarding consumer representation in real estate transactions. “Agency” was brought about by numerous lawsuits resulting from consumers being unclear as to who the agent was representing. North Carolina has three types of agency relationships: Buyer Agency, Seller Agency, and Disclosed Dual Agency.

In Buyer Agency, the agent works in the buyer’s best interest throughout the home buying process. Here in North Carolina, the buyer’s agent is paid by the seller through the commission split entered into the Multiple Listing Service by the seller’s agent. The home seller agrees to this commission split when they sign the listing agreement. In other parts of the country, it might be common practice for the buyer to pay the agent through a negotiated fee arrangement.

In Seller Agency, the agent known as the listing agent, is hired to represent the seller. It is the listing agent’s job to get the best price and terms for the seller.

Disclosed Dual Agency – In this situation, an agent represents both the buyer and seller in the same real estate transaction. All parties must give their written informed consent because of the potential for conflicts of interest in the dual agency relationship.

What is Due Diligence?

Due Diligence was added to our Offer to Purchase contract in North Carolina in 2011. In the contract, there is a negotiated time frame for buyers to investigate the property, do inspections, and apply for their financing. Another item to be negotiated is the due diligence fee. This money compensates the seller for taking their home off the market. The buyer writes the due diligence check directly to the seller.

If the home closes, the amount of the due diligence fee shows as a credit on the buyer’s closing disclosures. However, if the buyer for some reason decides to terminate the contract before the end of the due diligence period, the buyers do not get the due diligence money back. During the due diligence period, the buyer can walk away from the contract at anytime and the buyers do not have to give a reason for terminating the contract.

How should I handle repairs?

During the due diligence period in the contract, the buyer will have inspections completed on the property. The inspectors will furnish reports to the buyers who will review them with their agent and decide what items they might want to request the seller to repair or replace.

Request repairs start the negotiations going back and forth again between the buyers and sellers. The sellers have several options:

- Repair the items themselves

- Hire a contractor

- Lower the final sales price

- Negotiate on which items to repair

- Offer to split the repair costs

- Decline the repair request

It is a good idea for both parties to know the estimated costs of the repairs and not just guess at a figure. A buyer might think that something will cost $1,000, but it turns into a $5,000 repair.

Home repairs can cause a transaction to fall apart. More and more sellers today are seeing the value of investing in a pre-inspection on the property they are preparing to sell.

How long will it take to close once my home is under contract?

It usually takes around 45 days to close on a home once it is under contract. This will give the buyers’ lender time to process the loan application and order an appraisal. The home inspections will be completed during this time. Any contract contingencies will be taken care of. Your agent will be checking on the status of the transaction during this time to make sure everything is on track to successfully close.

Request More Information